Trucking

Track every mile. Deduct every dollar.

Expensify helps truckers and fleet operators capture receipts, track mileage, and get reimbursed on the road.

Snap receipts on the go

Track every mile

Get reimbursed fast

Stay audit-ready

Built for truckers

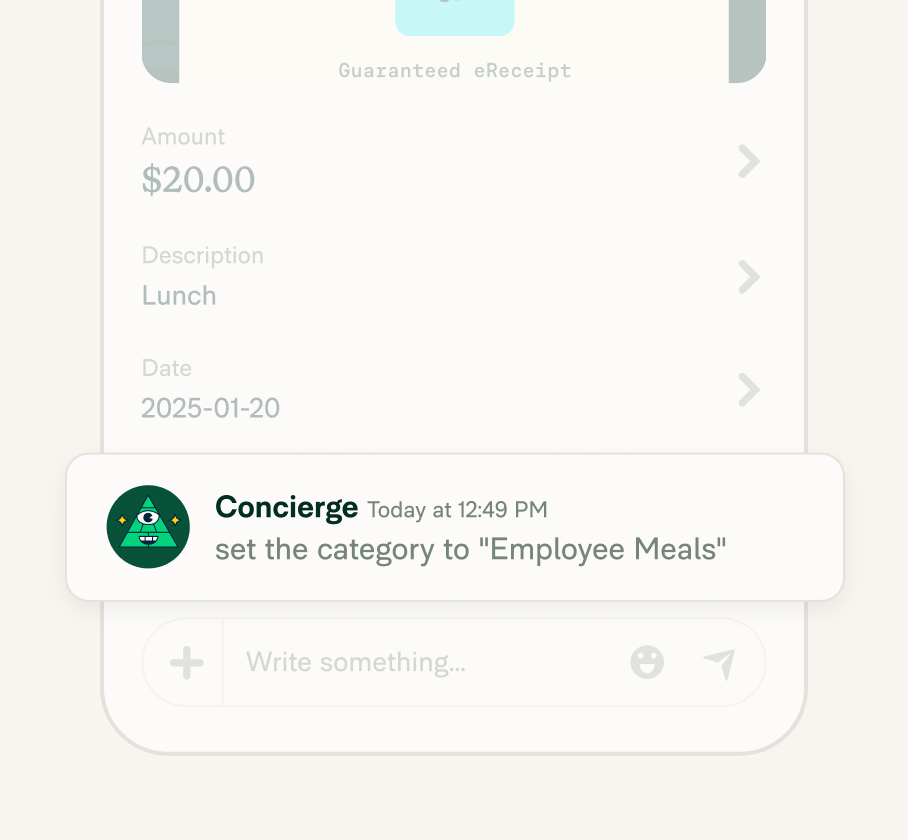

Automatically categorize expenses

Expensify intelligently categorizes expenses, saving truckers the hassle of manual sorting. Automatic expense organization simplifies the process for claiming deductions when filing trucking expenses for taxes.

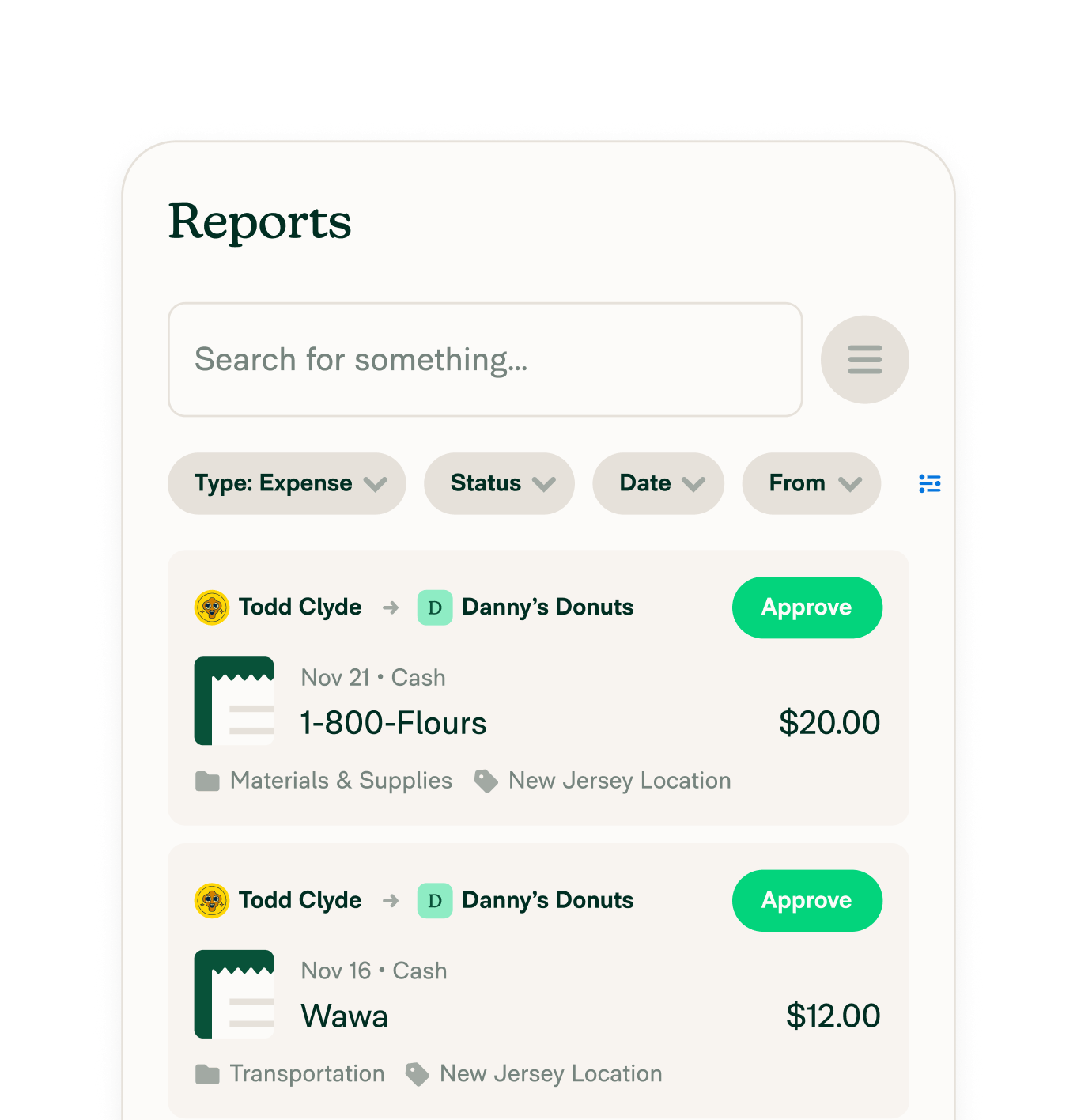

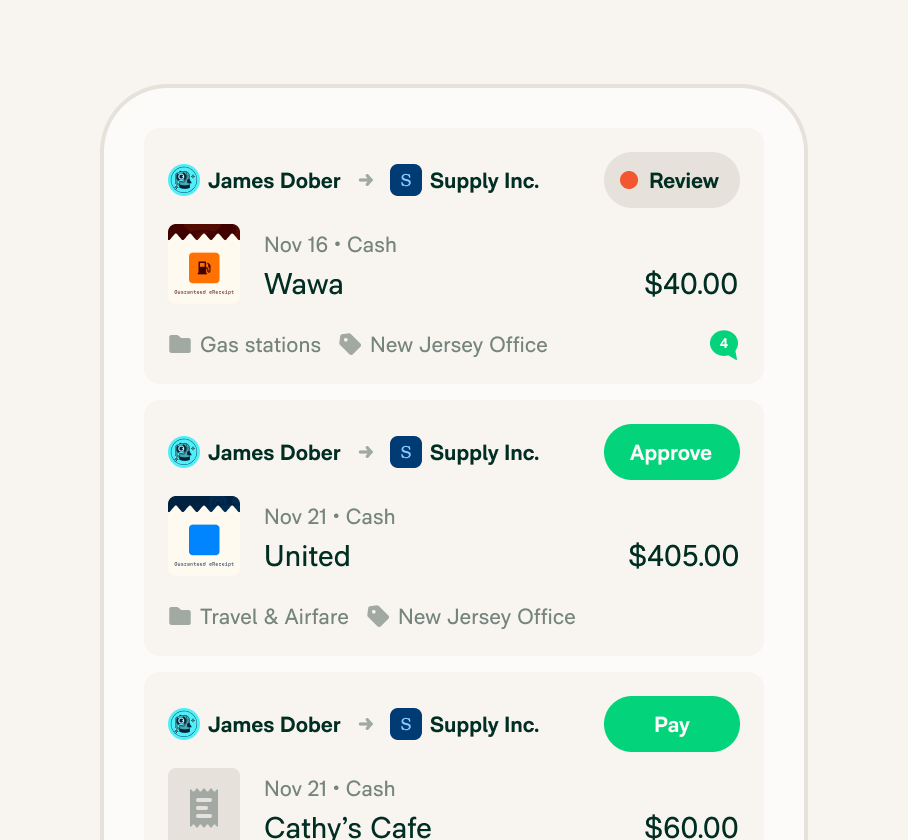

Get reimbursed fast

Submit your trucker expenses for reimbursement, and your reports are instantly available for review and approval. Now, truck drivers can recoup their out-of-pocket expenses quicker than ever before.

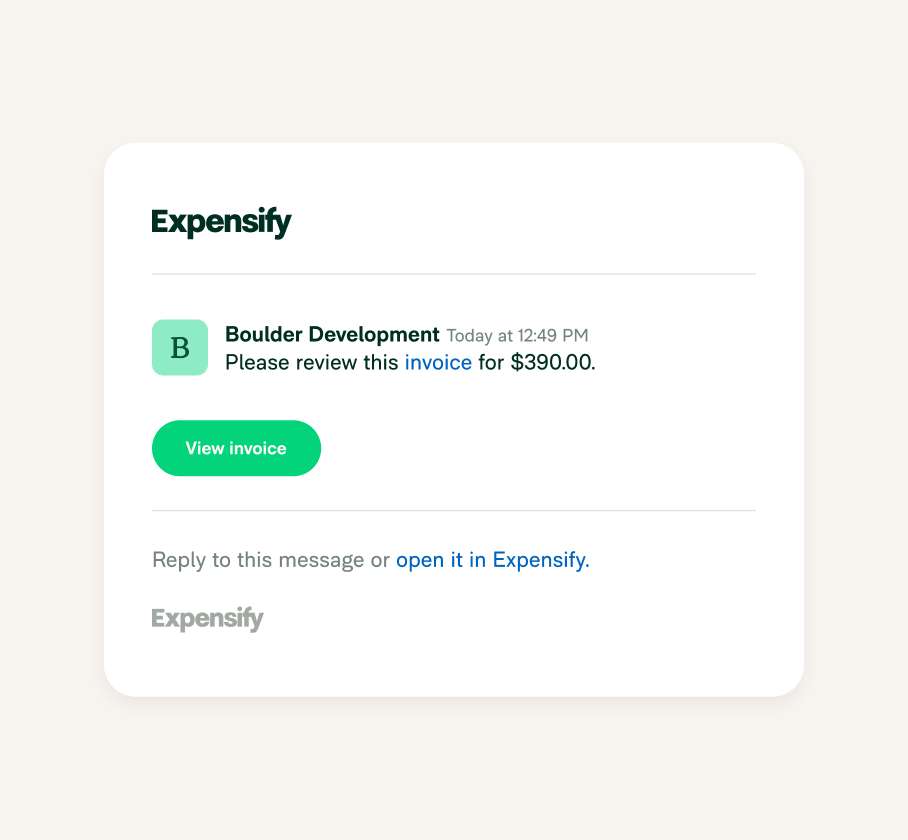

Invoice your clients with a click

Create and send professional invoices directly from Expensify, ensuring prompt payment and a smoother cash flow for your trucking business.

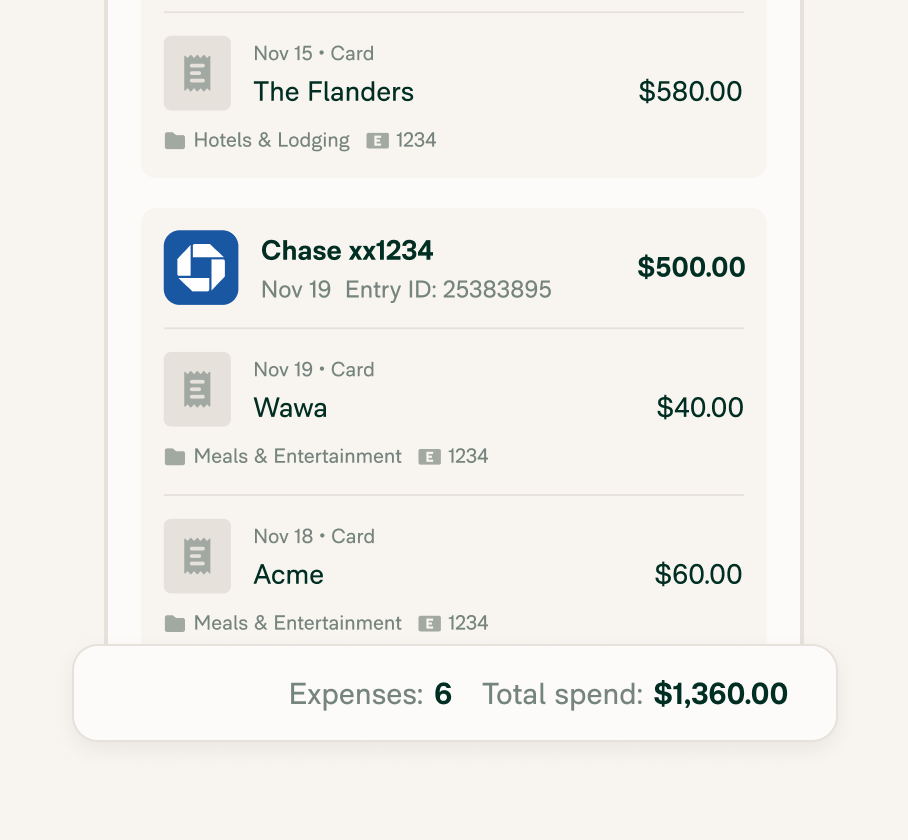

Reconcile your credit cards

Link personal and corporate cards to Expensify for automatic transaction import, expense coding, receipt matching, and reconciliation.

“Everyone loves Expensify because it’s such an easy tool to use for capturing expenses and getting paid back. From our internal employees to our truck drivers on the ground, everyone loves how simple it is to capture their expenses and get reimbursed.” - Paul Baresh, Operations & Account Services VP at Turnkey

FAQs

-

What can a truck driver claim on their taxes? They can write off a variety of expenses that are ordinary and necessary to the profession. The best part? These deductions can significantly reduce their taxable income at year-end.

Here are some of the common truck driver deductibles:

Fuel costs: A major expense, drivers can deduct the cost of fuel required for business-related travel.

Maintenance and repairs: Regular maintenance and necessary repairs to keep the truck in proper working order are deductible.

Meals and lodging: The truck driver per diem tax deduction allows drivers to deduct meal and accommodation expenses while on the road.

Travel expenses: Costs associated with business travel, including parking fees and tolls, can be written off.

Trucking taxes and licenses: Any taxes or fees paid to operate the truck legally are deductible.

Insurance premiums: Commercial insurance premiums for the truck are deductible as a business expense.

Supplies and equipment: Necessary items such as log books, gloves, and cleaning supplies used in the course of business are deductible.

Communication expenses: Costs for mobile phones and internet service, vital for job communication, can be written off.

-

Trucking expenses are broadly categorized as the costs incurred in the normal operation of a commercial truck. These expenses typically include fuel, maintenance and repairs, meals and lodging, trucking taxes, license fees, insurance premiums, and equipment and supplies.

Additionally, travel expenses such as tolls and parking fees, along with communication costs for mobile phones and the internet essential for job coordination, also come under truck driver expenses for taxes.

-

The standard meal allowance, also known as the "per diem" rate, for truck drivers is set by the IRS to cover daily food and beverage costs while on the road. It simplifies tax preparation by providing a predetermined deduction amount without the need to save every meal receipt. For 2025, truck driver per diem tax deduction is $80 per day for travel within the U.S. and $86 per day for travel outside the U.S

-

Yes, as a depreciable asset, an 18-wheeler can be written off for tax purposes, which means its cost can be gradually deducted over its useful life as specified by IRS guidelines. The process, called depreciation, allows for the truck’s cost to be spread across several tax years, potentially reducing the taxable income each year.

The Section 179 deduction also enables truckers to deduct a significant portion of the 18-wheeler’s cost in the first year of service, subject to certain limitations and requirements.

-

Fuel is typically the largest ongoing expense for truckers, often making up over 25%–30% of total operating costs. Other major costs include insurance, maintenance, licensing fees, and vehicle depreciation, all of which are trackable and deductible with Expensify.

-

Start by logging all business-related spending: fuel, meals, tolls, maintenance, and more. Use Expensify to auto-categorize and match each expense to receipts and transactions. This creates a clear paper trail for reimbursements and tax filing, eliminating manual calculations.

-

To budget effectively, track every expense in realtime. Use categories to spot where costs are rising (e.g. fuel or repairs), set per diem limits for meals, and log mileage for accurate deductions. Expensify helps you automate this so budgeting becomes a habit, not a hassle.

-

Expensify is one of the top-rated expense tracking apps for truckers. From SmartScan receipts to GPS-powered mileage tracking, it keeps everything in one place, whether you’re managing per diems, fuel, or meal logs for tax time.

Try Expensify today

See how much time you can save by integrating Expensify with Gusto. From onboarding to expense reporting to reimbursement, everything just works faster, smarter, and easier.

Start your free trial