Self-Employed

Track every expense for tax season

Freelancers and contractors use Expensify to capture receipts, categorize expenses, and stay tax-ready with AI-powered automation.

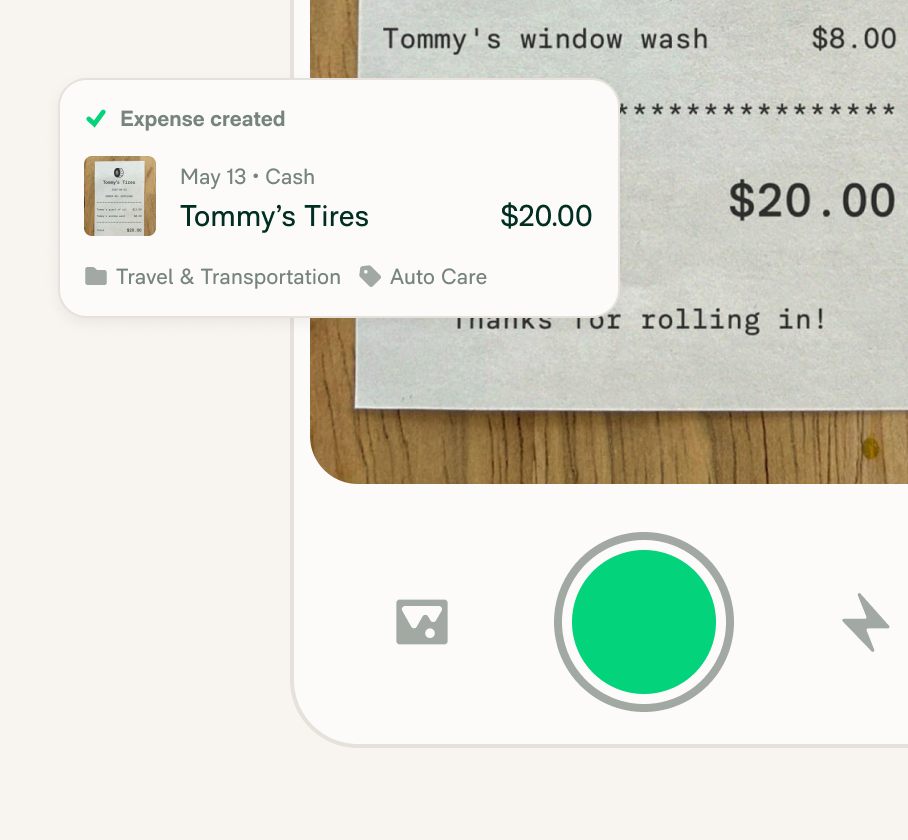

Snap receipts instantly

Track mileage accurately

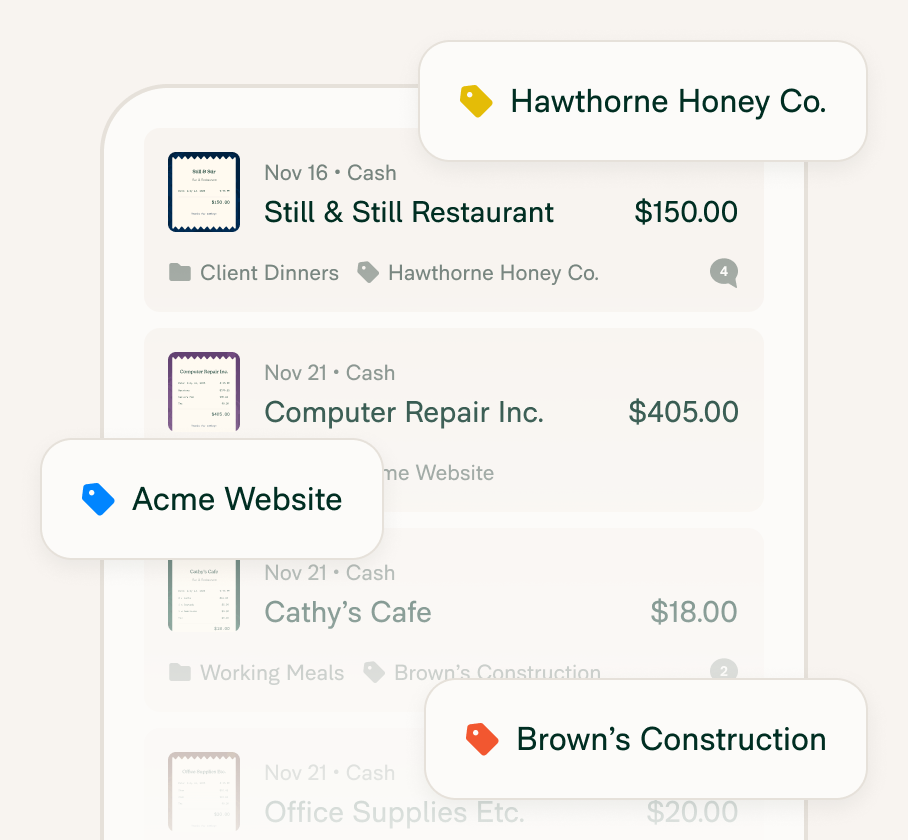

Categorize by client/project

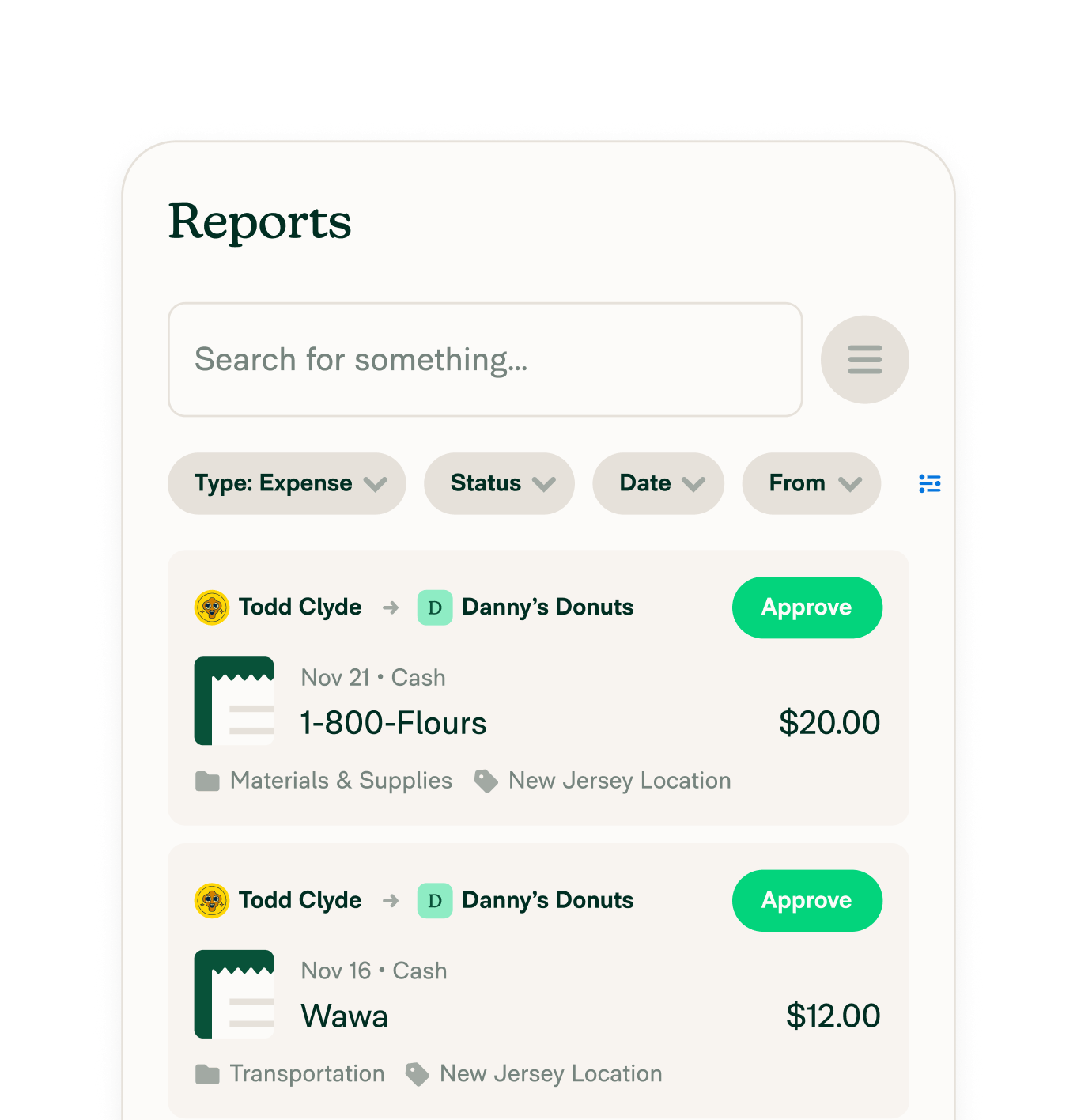

Generate expense reports in realtime

Built for solopreneurs, consultants, contractors, and self-employed professionals

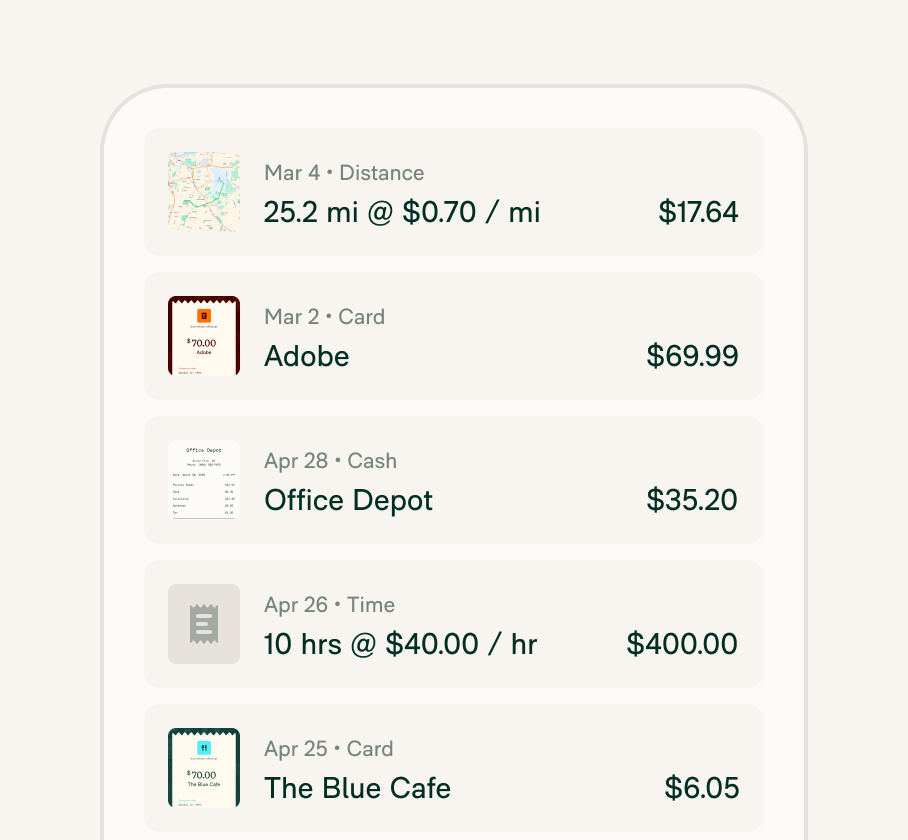

Maximize your deductions

Track meals, miles, subscriptions, supplies (anything business-related), and create tax-friendly reports to stay on top of your self-employed write-offs with zero spreadsheet work.

Say goodbye to paper receipts

Snap a photo of your receipt using Expensify, use your phone’s camera app and email it to receipts@expensify.com, or text it to 47777 (US numbers only). Let Expensify handle the rest. Everything’s stored, sorted, and ready when you need it.

Separate personal and business spend

Keep your finances crystal clear by organizing expenses with filters, custom columns, or separate workspaces. Avoid messy tax prep and stay audit-ready year-round.

FAQs

-

“Solopreneur” refers to a self-employed individual who operates their business single-handedly, typically without building a team or hiring employees. Solopreneurs often focus on personal branding and manage all aspects of their business.

In contrast, a self-employed business owner might work alone or with a team, and aim to grow their business beyond their personal capabilities, possibly hiring staff or outsourcing certain tasks to manage and expand their operations.

-

Yes, those who are self-employed absolutely need bookkeeping. This critical task involves recording, organizing, and managing financial transactions, including sales, purchases, payments, and receipts.

Done effectively, it helps business owners maintain accurate financial records, comply with legal obligations, monitor their business performance, plan budgets, and prepare for self-employed taxes.

-

If you’re self-employed, you can deduct a wide range of ordinary and necessary business expenses, including supplies, software, home office costs, internet and phone bills, professional services, and mileage.

You can also write off things like meals and travel, as long as they’re directly related to your business. Keeping accurate records is essential to maximizing your deductions and avoiding issues with the IRS. With Expensify, you can categorize and track these expenses in real time, making tax season far less stressful.

-

Small business owners can deduct a variety of self-employed travel expenses that are “ordinary and necessary” for their business.

These may include the following:

Airfare, train, and bus tickets

Accommodation costs

Car rentals and mileage (standard IRS mileage rate)

Parking and toll fees

Meals (subject to 50% limitation in most cases)

Other travel-related expenses like baggage fees, business calls, and tips

-

There's no limit to the number of legitimate business expenses you can write off as a self-employed professional. The IRS allows you to deduct any ordinary and necessary expenses related to running your business, from home office costs and equipment to software subscriptions and client meals.

The key is ensuring each expense is business-related and properly documented. Many solopreneurs discover they can deduct far more than expected, often saving thousands in taxes annually.

-

Yes. A self-employed expense tracker helps solopreneurs stay organized, save time, and reduce errors when tracking business spend. Using an expense tracking app for independent contractors makes it easier to manage receipts, mileage, and reports – especially when preparing invoices or getting ready for tax season.

-

You should also use an expense tracker like Expensify to label, categorize, and filter expenses by type, especially if you’re invoicing clients or managing different income streams. The cleaner your records, the more confident you’ll be when filing taxes or applying for financing.

You can also open a separate bank account or credit card for your business expenses. This makes it easier to track what’s deductible and protects you during tax time or an audit.

-

The IRS $75 rule allows self-employed individuals to skip submitting a receipt for any business expense under $75, except for lodging or certain transportation-related expenses. However, you’re still required to record the amount, time, place, and business purpose of the expense for it to qualify.

Using an app like Expensify as a self-employment expense tracker makes this easy by automatically logging these details, even when receipts aren’t required.

Remember: organized documentation matters just as much as the receipt itself.

Try Expensify today

See how much time you can save by integrating Expensify with Gusto. From onboarding to expense reporting to reimbursement, everything just works faster, smarter, and easier.

Start your free trial